triple bottom stocks meaning

The triple bottom line illustrates. The wider the pattern the better established the support level and the more important the subsequent breakdown.

The Triple Bottom Candlestick Pattern Thinkmarkets En

Both represent a shift in pressure.

. If the stock price or index actually breaks through on the downside during the third attempt it is a bearish signal and the investor should sell or sell short the stock or index. It also addresses social and environmental concerns. It is very dependable in stock chart patterns used in technical analysis.

Triple Bottom Line also known as TBL or 3BL is a transformational framework for businesses to achieve sustainability and financial success. The Triple Bottom Line in business aids in measuring benchmarking setting goals continually improving and adopting sustainable systems. While the opening term denotes the meaning of four levels or layers the bottom line is something you need to understand before indulging further into this topic.

As far as the stock market is concerned the bottom line is the basic income or earnings of a company per share. Covid-19 Stock Market Commodities World News Latest Economy ForexCurrency. Before the term became known the bottom line in a business was focused mostly on the financial side profit and.

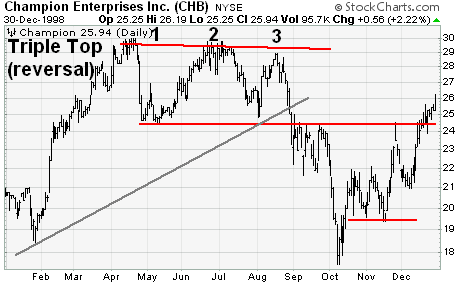

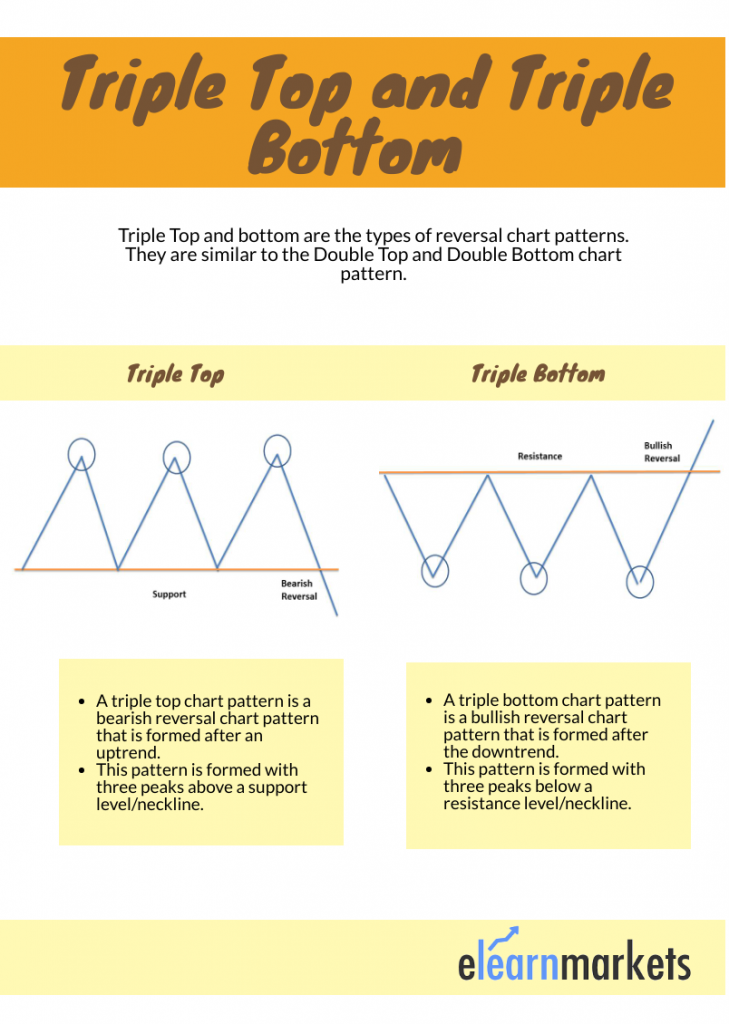

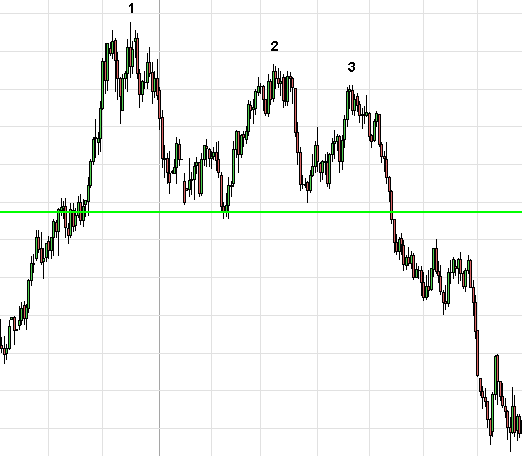

A Triple Top is one of the most reliable stock chart patterns found in technical analysis charts. It is a variation of the Head and Shoulders pattern except that the three peaks all top around the same price level in a similar way to. The triple bottom line TBL is a business and accounting framework that believes companies should care about social and environmental concerns just as they do their profits.

Most of the rules that are applied in the formation of the triple top can be reversed in the formation of triple bottom. Triple Bottom is a chart pattern with three bottom s very close in price. Tools within the triple bottom line help to measure benchmark set goals improve and eventually evolve toward more sustainable systems and models.

Just that the three peaks top around the. There are three equal lows followed by a break above resistance. Cryptocurrency Live IPO Featured Zone - Our Clients Market Updates.

The first use of it was credited to John Elkington who founded a consulting firm called SustainAbility. It is considered complete indicating a further price slide once the price moves below support level. A breakout will result in the trend reversal.

The term quadruple bottom line consists of two common words. The triple bottom line is a transformation framework for businesses and other organizations to help them move toward a regenerative and more sustainable future. It reflects building up of positive sentiment among market players and signals a bullish reversal majorly supported by strong volumes.

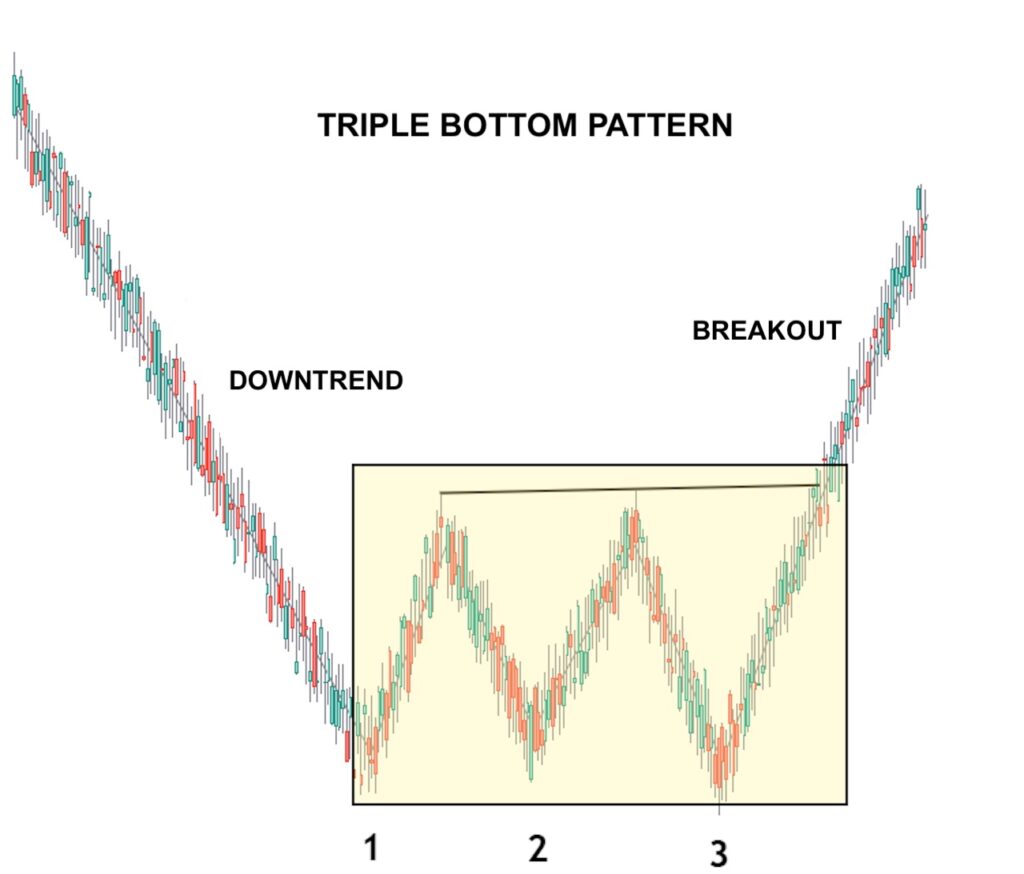

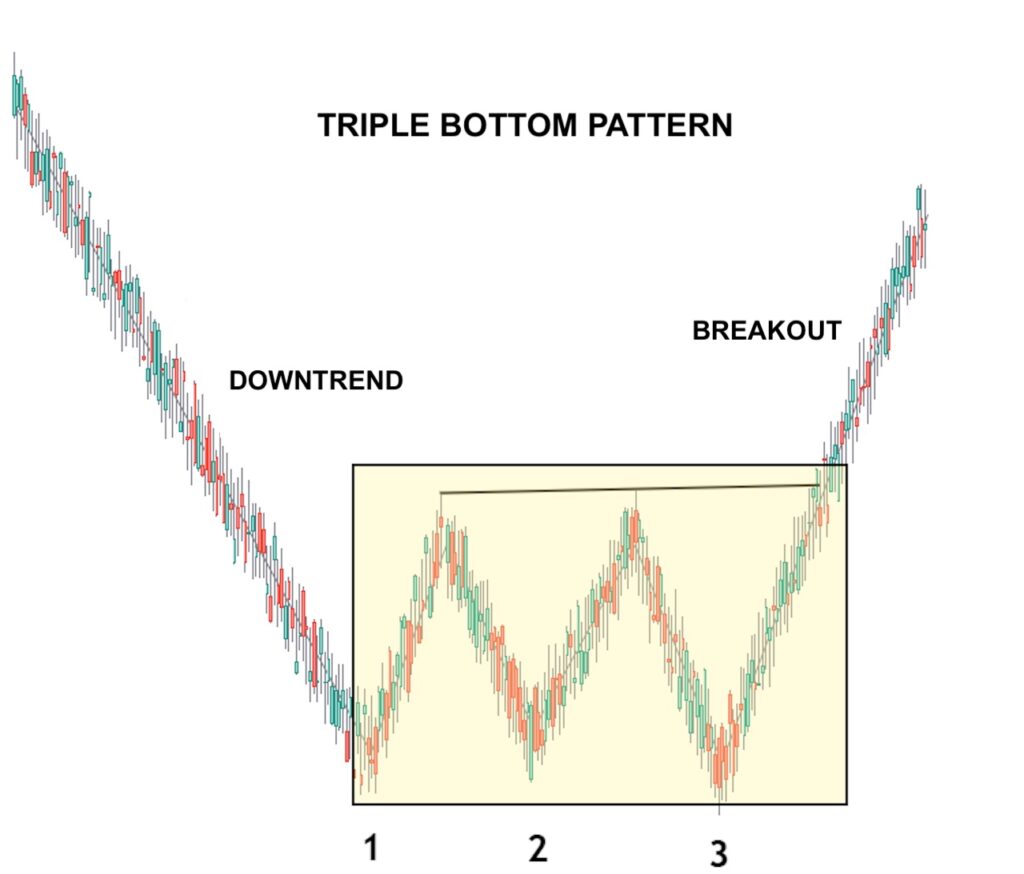

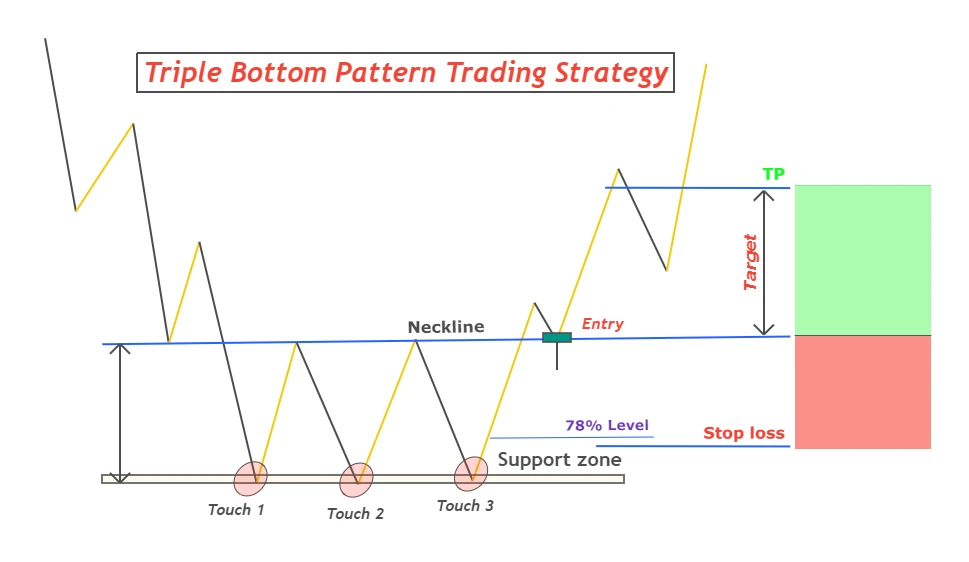

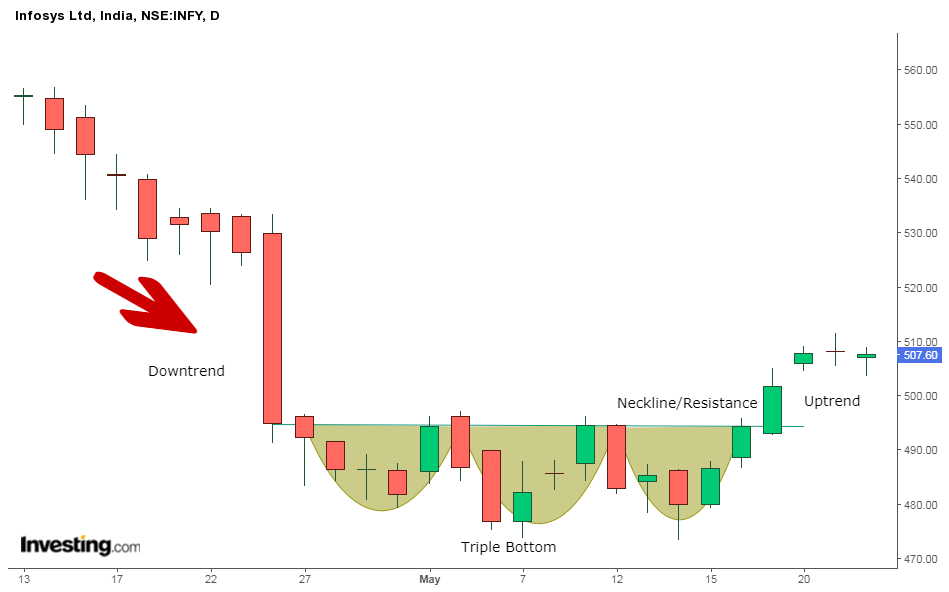

From this basic pattern the bearish breakdown patterns become wider and more complex. The Triple Bottom Reversal is a bullish reversal pattern typically found on bar charts line charts and candlestick charts. A triple bottom is a reversal pattern with bullish implications composed of three failed attempts at making new lows in the same area followed by a price move up through resistance.

The Triple Bottom Stock Pattern is a chart pattern used in technical analysis thats identified by three equal lows followed by a breakout above the resistance level. This pattern is a specific form of the head and shoulders pattern. It is a straight forward formation defined by three clear peaks in the market at about the same price levels.

The triple bottom is a bullish reversal chart pattern that could be an indication that sellers bears are losing control of a downtrend and that buyers bulls are taking over. The estimated downside target for the pattern is the height of the pattern subtracted from the breakout point. Triple Bottom Line Definition and Example Triple Bottom Line Meaning Stock Market Terms Related Terms Means.

The chart example above shows a triple bottom formation that turned the EURGBP forex pair to the upside after a downtrend. Triple bottom line is the accounting framework which draws the attention of business managers to incorporate social and environmental factors along with the financial aspects. The formation of Triple bottom occurs during the period.

A triple top or triple peak is a bearish chart pattern. The Triple Bottom is one of the technical formations that indicates a bullish outlook for the stock commodity index. A Triple Top Stock Pattern is formed by three peaks moving into the same area with pullbacks in between.

AUS AUS USA UK NZ CA. It is straightforward and it is defined by three clear peaks that form about the same level in the market. When a company emphasizes on its financial value economic standing profits and revenues it must also give considerable thought to its social and environmental.

The most basic PF sell signal is a Double Bottom Breakdown which occurs when an O-Column breaks below the low of the prior O-Column. This pattern is rare but a very reliable buy signal. The triple bottom formation is formed because investors and hedge funds think that theres a.

This means implications there have been three failed attempts at making new lows in the same area followed by a price move up through resistance. The triple bottom line definition brings people and the. A triple top or bottom signifies that an established trend is weakening and that the other side is gaining strength.

People profits and the planet. After the first low price corrected higher. As far as volume is concerned the third low bottom should be on low volume and the rally up from that bottom should show a marked increase in activity.

As major reversal patterns these patterns usually form over a 3- to 6-month period. Triple bottom line is a term which describes a business that focuses on three main things. Triple bottom In technical analysis a chart formation of a stock or a market index that has attempted to penetrate a lower price level on three different occasions.

The bottom line has always been a reference to financial statements ending with a companys profit or losses. Note that a Triple Bottom Reversal on a bar or line chart is completely.

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

Technical Analysis Triple Tops And Bottoms

Triple Top Pattern Explained Stock Chart Patterns

What Are The Must Read Books On Price Action Trading Quora

Triple Bottom Reversal Chartschool

Triple Top Reversal Chartschool

Bybit Learn What Are Triple Top And Bottom Patterns In Crypto Trading

The Triple Bottom Candlestick Pattern Thinkmarkets En

Triple Bottom Pattern And Triple Top The Ultimate Guide

The Complete Guide To Triple Top Chart Pattern

What Is Triple Bottom Pattern Trading Strategy Explained Forexbee

The Complete Guide To Triple Top Chart Pattern

How The Triple Bottom Reversal Pattern Works 1 Options Strategies Center

The Triple Bottom Candlestick Pattern Thinkmarkets En

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-02-8412f60315fe4e75801c37d04bebd526.jpg)

Technical Analysis Triple Tops And Bottoms

Triple Bottom Pattern And Triple Top The Ultimate Guide

Triple Bottom Reversal Chartschool

/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)