what state has the highest capital gains tax

27 2017mark ralstonafp via getty images California has the highest capital gains tax rate of 1330. Taxes capital gains as income and the rate reaches 853.

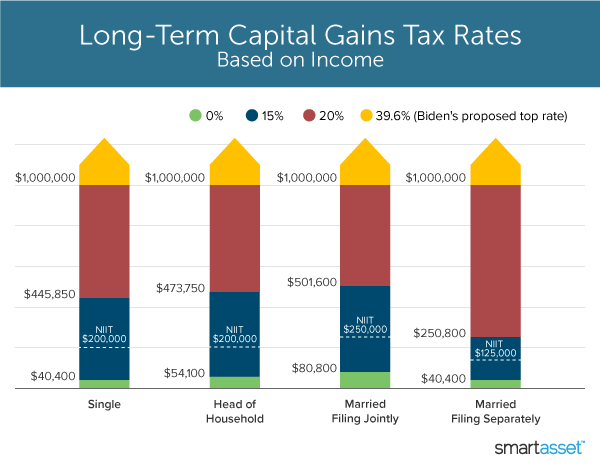

20 if your income was 445850 or more.

. The Grassroot Institute of Hawaii would like to offer its comments on SB2242 which seeks to create additional tax brackets thus raising the states top income tax rate from 11 to 13. Capital Gains Tax Rate 2022. Hawaii taxes capital gains at a lower rate than ordinary income.

This applies to long-term and short-term capital gains. That means you pay the same tax rates you pay on. Including the average state taxes and the net investment income.

State and local taxes often apply to capital gains. The nine states with no personal income tax Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming have the lowest rate in the United. The average country in the Organization for Economic Cooperation and Development has a top marginal capital gains tax rate of 191.

California taxes capital gains as ordinary income. If there was one country that could beat out the high tax rates in The Land of the Free. Hawaii taxes capital gains at a lower rate than ordinary income.

What is the capital gains tax rate in Connecticut. The 10 states with the highest capital gains tax are as follows. Some States Have Tax Preferences for Capital Gains.

California with a top rate of 33 percent has the third highest capital gains tax rate in the industrialized world. The federal government taxes income. According to a House Ways and Means Committee staffer taxpayers who earn more than 400000 single 425000 head of household or 450000 married joint will be subject to the highest federal tax rate beginning in 2022.

California 33 percent New York 316 percent Oregon 312 percent and Minnesota 309 percent. As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket. The states with the highest top marginal capital gains tax rates.

Denmark 42 to 59. States have seven of the top ten capital gains tax rates in the OECD. If enacted this bill also would increase the capital gains tax from 725 to 11 and hike the corporate income tax rate and income tax rates on investment.

The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries. The 10 states with the highest capital gains tax are as follows. If your taxable income is less than 80000 some or all of your net gain may even be taxed at zero percent.

California taxes capital gains as ordinary income. In a state whose tax is stated as a percentage of the federal tax liability the percentage is easy to calculate. If you are filing your taxes as a single person your capital gains tax rates are as follows.

5 US States and Countries with the Highest Capital Gains Taxes 1. Therefore the top federal tax rate on long-term capital gains is 238. California has notoriously high taxes and with up to 396 in federal taxes alone the state taxes can seem especially deep.

The golden state also has a sales tax of 725 the highest in the country. California has the highest capital gains tax rate of 1330. The 10 states with the highest capital gains tax are as follows.

This tax is known as the net investment income tax. At the other end of the spectrum California has the highest capital gains tax rate at a whopping 133. He United States has one of the highest capital gains taxes in the world.

States With the Highest Capital Gains Tax Rates. Its a whopping 39 on long-term capital gains and 20 on short-term capital gains. Breaking this down further the states with the highest top marginal capital gains tax rates are California 33 percent New York 316 percent Oregon 312 percent and Minnesota 309 percent.

California United States 33. How are capital gains taxed in 2019. If youre looking for a country with lower tax rates look no further than Estonia.

The highest rate reaches 11. The capital gains tax on most net gains is no more than 15 percent for most people. The highest rate reaches 133.

The Estonian government only charges 24 to those who are lucky enough to live there. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains. California taxes capital gains as.

Im always fascinated to see Chinese investors flocking to buy homes in Southern. In 2019 and 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. State and local taxes often apply to capital gains.

In a state whose tax is stated as a percentage of the federal tax liability the percentage is easy to calculate. Even taxpayers in states without taxes on capital gains face top rates higher than the OECD average. The state Tax Department calculates that boosting the top capital gains tax rate would allow the state to collect an extra 100 million a year or more even after deducting the cost of providing a.

House members take their oaths of office on. States With the Highest Capital Gains Tax Rates. The state with the highest top marginal capital gains tax rate is California 33 percent followed by New York 315 percent Oregon 31 percent and Minnesota 309 percent.

Tax on capital gains would be increased to 288 per cent by House Democrats. Connecticut has a capital gains tax of 7. Therefore the top federal tax rate on long-term capital gains is 238.

The lowest rate of 25 percent is shared among the nine states with no personal income tax Alaska Florida Nevada New Hampshire South Dakota Tennessee. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Calculate Capital Gains Tax H R Block

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What S In Biden S Capital Gains Tax Plan Smartasset

Guide To Capital Gains Tax Times Money Mentor

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)